Customer Payments Platform (CPP) is now officially recognised as a State Digital Asset.

Customer Payments Platform

The safe, secure and compliant payment solution designed for today’s citizens and government agencies.

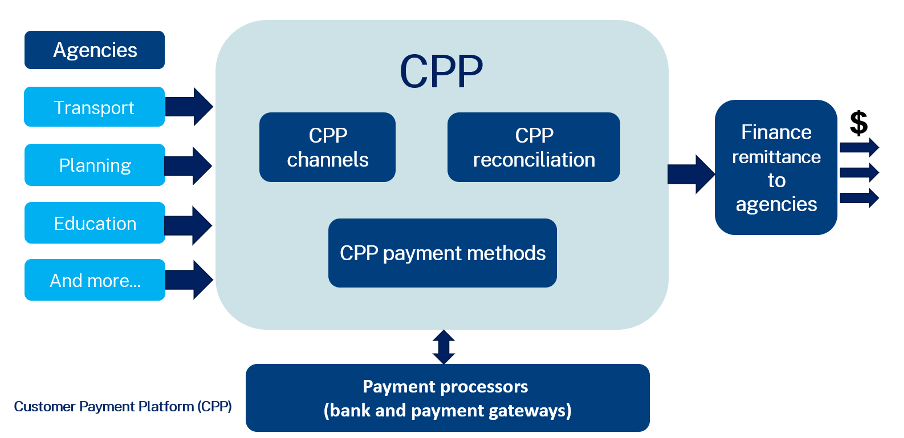

Customer Payments Platform (CPP) is a whole of government payment platform delivering a seamless, end-to-end payments experience across government and supporting a range of payment methods.

CPP is a State Digital Asset. Over 30 agencies use the platform, with 17 million transactions worth over $5 billion processed in 2024-25.

Outcomes and Benefits

- Provides customers with a seamless, secure payment experience across all NSW Government agencies

- Eliminates the need for agencies to connect to multiple payment providers with the flexibility to roll out new payment methods quickly

- CPP provides agencies with full transactional level reconciliation across multiple channels through a single platform whilst supporting the reduction of payment related costs.

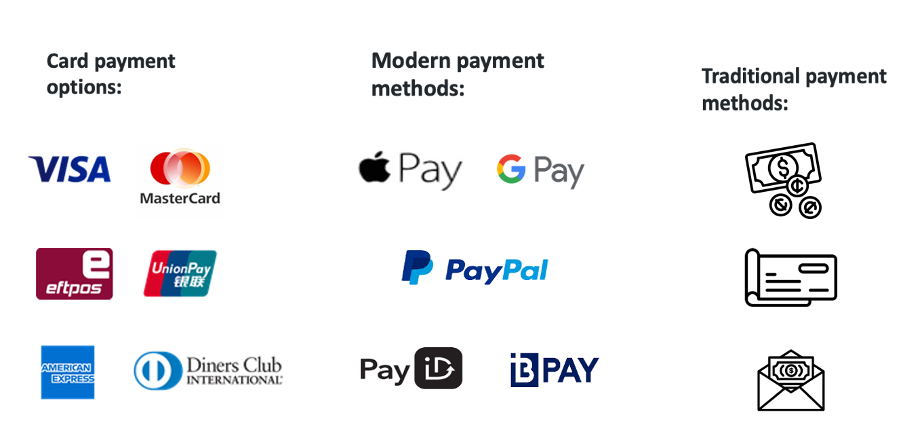

- Multiple payment options with surcharging capability e.g., VISA, MasterCard, Amex, UnionPay, Diners, eftpos, PayPal, BPAY, NPP and Direct Entry

- Integrates with other platforms such as Virtual Contact Centre

- CPP is PCI-DSS compliant

How does a transaction on the Customer Payment Platform work?

CPP is a robust, reusable payments capability that creates a more consistent customer experience and reduces costs. It is an abstraction layer between agency transaction systems and banks which allows straight through processing.

CPP capabilities

| Citizens and Businesses | Agencies |

|---|---|

|

|

Payment Methods

Payments Compliance and Security

- PCI-DSS

- ISO-27001

- Surcharging Compliance with ACCC regulation

Want to know more?

Visit our frequently asked questions page or get in touch by emailing GTPpartnerships@customerservice.nsw.gov.au